December 19, 2023

Published by Inside Tax at December 19, 2023

Categories

Navigating the Indian tax landscape demands vigilance, especially given the prevalence of tax scams. In this post, we’ll delve into common tax scams, signs to be […]

November 21, 2023

Published by Inside Tax at November 21, 2023

Categories

Picture this: a world where the rich not only get richer but also smarter about their money. In this article, we’re diving into the intriguing world […]

October 26, 2023

Published by Inside Tax at October 26, 2023

Categories

Many Indians find themselves living and working overseas in a world that is becoming more interconnected, all the while keeping close ties to their homeland. These […]

October 23, 2023

Published by Inside Tax at October 23, 2023

Categories

People frequently experience a mix of excitement and nervousness during tax season. Although the possibility of a return is enticing, this is also the time of […]

October 6, 2023

Published by Inside Tax at October 6, 2023

Categories

Navigating Tax Season Safely Tax season can be a stressful time for many individuals and businesses, and unfortunately, it’s also a time when tax scams and […]

September 22, 2023

Published by Inside Tax at September 22, 2023

Categories

When it comes to income tax returns (ITR), timely refunds and efficient processing are crucial aspects of a taxpayer’s journey. In this era of digital transformation, […]

September 21, 2023

Published by Inside Tax at September 21, 2023

Categories

Under the Goods and Services Tax (GST) system, filing GST returns on time is a crucial obligation for individuals, traders, organizations, and companies. It involves providing […]

August 29, 2023

Published by Inside Tax at August 29, 2023

Categories

The experience of receiving income tax notices after filing an income tax return (ITR) often brings stress and confusion. Many taxpayers struggle to comprehend the motives […]

August 28, 2023

Published by Inside Tax at August 28, 2023

Categories

Retirement planning is a crucial aspect of financial well-being, and in India, there are several investment options available that offer tax benefits along with the potential […]

July 27, 2023

Published by Inside Tax at July 27, 2023

Categories

As the deadline for Income Tax Return (ITR) filing approaches, it is essential for Indian taxpayers with foreign assets, bank accounts, or earnings to be aware […]

July 12, 2023

Published by Inside Tax at July 12, 2023

Categories

Understanding tax planning tactics is essential for small business owners in India if they want to maximise their financial assets while adhering to the law. You […]

July 4, 2023

Published by Inside Tax at July 4, 2023

Categories

The government of India has announced a reduction in the Goods and Services Tax (GST) on electronic items. This is good news for consumers, as it […]

June 30, 2023

Published by Inside Tax at June 30, 2023

Categories

Partnership is a popular business entity in India where two or more individuals come together to carry out a business and share the resulting profits in […]

June 28, 2023

Published by Inside Tax at June 28, 2023

Categories

Tax Deducted at Source (TDS) is a crucial aspect of compliance with Indian Income Tax regulations, particularly when it comes to cash transactions. The Indian government […]

June 27, 2023

Published by Inside Tax at June 27, 2023

Categories

Inside Tax Consultants, a renowned CA firm in Delhi specializes in providing top-notch GST services to businesses. With over 7+ years of experience in the industry, […]

June 19, 2023

Published by Inside Tax at June 19, 2023

Categories

Tax Implications for YouTubers and Influencers: Understanding the Income Tax and GST Rules YouTube video blogging, or vlogging, has become immensely popular, with many content creators […]

May 31, 2023

Published by Inside Tax at May 31, 2023

Categories

When an individual’s professional receipts exceed INR 50 lakhs, they enter a different tax compliance category. This article delves into the various compliances and procedures that […]

May 26, 2023

Published by Inside Tax at May 26, 2023

Categories

There are many strategies to reduce taxes and reap the biggest savings. A better strategy is to start making purchases in the first quarter of the […]

May 25, 2023

Published by Inside Tax at May 25, 2023

Categories

What is Form 16? Form 16 is a certificate issued by employers to employees, providing a detailed summary of salary payments and TDS deductions. TDS is […]

May 15, 2023

Published by Inside Tax at May 15, 2023

Categories

On Wednesday, the Income Tax Department made forms that are offline to file income tax returns available. As of right now, the I-T Department has made […]

April 24, 2023

Published by Inside Tax at April 24, 2023

Categories

Investing in stocks can be a great way to grow your wealth over time. However, it’s important to understand the tax implications of investing in stocks, […]

April 21, 2023

Published by Inside Tax at April 21, 2023

Categories

IT departments all across the world are preparing for the start of the new fiscal year as we speak. IT departments are in charge of making […]

April 13, 2023

Published by Inside Tax at April 13, 2023

Categories

Tax calculator, tax calculator 2023, tax calculator fy 2023 24, income tax login, income tax portal, income tax calculator The IT department releases an online tax […]

March 29, 2023

Published by Inside Tax at March 29, 2023

Categories

Entrepreneurship is a challenging yet rewarding journey, especially in India, where the government has been actively encouraging and promoting the growth of Micro, Small & Medium […]

March 28, 2023

Published by Inside Tax at March 28, 2023

Categories

As the current financial year (FY 2022-23) draws to a close, taxpayers should take advantage of some tax deductions before the March 31st deadline. To save […]

March 27, 2023

Published by Inside Tax at March 27, 2023

Categories

As the tax season approaches, many people start to feel overwhelmed and confused by the complex world of income tax. If you’re a beginner, the process […]

March 24, 2023

Published by Inside Tax at March 24, 2023

Categories

By March 31, 2023, taxpayers must link their Permanent Account Number (PAN) to their Aadhaar, otherwise, the Central Board of Direct Taxes (CBDT) has stated that […]

March 2, 2023

Published by Inside Tax at March 2, 2023

Categories

A loan is simply the act of borrowing money with the intent to repay it over a predetermined period of time (tenor). You must pay the […]

February 6, 2023

Published by Inside Tax at February 6, 2023

Categories

By November, direct tax revenue increased by 24.2% to $8.7 billion. FinMin reports that 5.13 crore returns were made throughout July 2022, with 72.42 lakh ITRs […]

February 1, 2023

Published by Inside Tax at February 1, 2023

Categories

If you have paid the government more tax than the actual tax burden, you are entitled to get an income tax refund. This typically occurs when […]

January 30, 2023

Published by Inside Tax at January 30, 2023

Categories

Finance Minister Nirmala Sitharaman will introduce the Union Budget 2023 to Parliament on February 1. The budget for this year is projected to be growth-oriented, with […]

January 28, 2023

Published by Inside Tax at January 28, 2023

Categories

As February 1 draws nearer, we start to see wish lists from various social groups. The voice of the salaried class, which aspires for tax breaks […]

December 21, 2022

Published by Inside Tax at December 21, 2022

Categories

The majority of individuals are not aware of the advantages of paying taxes following the law. A 1% TCS is charged on vehicles costing more than […]

December 11, 2022

Published by Inside Tax at December 11, 2022

Categories

Indian credit card users’ monthly spending has risen sharply in recent years. Compared to debit cards, credit cards are more popular among users since they come […]

November 30, 2022

Published by Inside Tax at November 30, 2022

Categories

All About Tax Structure In India Taxes are an important and largest source of income for the government. The government uses the money collected from taxes […]

November 30, 2022

Published by Inside Tax at November 30, 2022

Categories

The MSME stands for Micro, Small and Medium Enterprises and is the main Government body that deals with the management & preparation of guidelines, rules, and […]

November 21, 2022

Published by Inside Tax at November 21, 2022

Categories

The Following 6 Transactions May Lead To An Income Tax Notice The income tax authority keeps an eye on high-value transactions, and these transactions may frequently […]

November 2, 2022

Published by Inside Tax at November 2, 2022

Categories

Do minors have to pay taxes? Yes, under section 64(1A), any income that is earned by or paid to a minor is included in the parent’s […]

October 31, 2022

Published by Inside Tax at October 31, 2022

Categories

Synopsis- Gifts are given to loved ones during Diwali. Even some businesses reward their workers with bonuses. Even though everyone enjoys receiving gifts, income taxpayers should […]

October 31, 2022

Published by Inside Tax at October 31, 2022

Categories

In India, tax incentives are available for tuition and other educational costs. Based on this, deductions of up to Rs. 1.5 lakh may be requested. Varying […]

October 31, 2022

Published by Inside Tax at October 31, 2022

Categories

Vinai Kumar Saxena, the lieutenant governor of Delhi, on Tuesday, unveiled the “SAMRIDDHI 2022–23” one-time property tax amnesty programme, claiming that it will be a significant […]

September 22, 2022

Published by Inside Tax at September 22, 2022

Categories

The R&D Tax Credit: What Is It? Companies that produce new or improved business components, such as goods, processes, computer software, techniques, formulas, or ideas, that […]

September 21, 2022

Published by Inside Tax at September 21, 2022

Categories

What is DIN? Each person who wants to become a director of a corporation or a designated partner in an LLP is given a special director […]

September 19, 2022

Published by Inside Tax at September 19, 2022

Categories

All of our daily activities were severely hampered by the lockdown. Even going outside to get some groceries gave me the impression that I was entering […]

September 13, 2022

Published by Inside Tax at September 13, 2022

Categories

Article 80G Donating to a charity that will then qualify for Section 80G deductions is one of the best methods to reduce your tax liability while […]

August 29, 2022

Published by Inside Tax at August 29, 2022

Categories

Who doesn’t want to run their own company? Everyone does. However, the dynamics have altered. Owning a business no longer requires setting up shop in a […]

July 28, 2022

Published by Inside Tax at July 28, 2022

Categories

A person must submit an Income Tax Return (ITR) form to the Indian Income Tax Department. It includes details on the individual’s earnings and the yearly […]

July 1, 2022

Published by Inside Tax at July 1, 2022

Categories

Income tax regulations: Three significant modifications to the income tax regulations that were outlined in the union budget of 2022 will take effect after the conclusion […]

June 30, 2022

Published by Inside Tax at June 30, 2022

Categories

Recommendations of 47th GST Council Meeting GoM on Casino, Race Course and Online Gaming to re-examine the issues based on further inputs from States and submit […]

June 27, 2022

Published by Inside Tax at June 27, 2022

Categories

When the IRS uses the alter ego theory to collect debts from company owners, this is referred to as “piercing the corporate veil.” If the IRS […]

June 21, 2022

Published by Inside Tax at June 21, 2022

Categories

Salary Income Is Taxable According to Section 5(2), a non-total resident’s income for any financial year comprises all profits generated from any source that – During […]

May 16, 2022

Published by Inside Tax at May 16, 2022

Categories

India is intending to curtail government expenditures on a few palatable oils to cool the home loan market after the conflict in Ukraine and Indonesia’s restriction […]

May 13, 2022

Published by Inside Tax at May 13, 2022

Categories

Tax planning or selecting the best investment option is undoubtedly a difficult process that many of us dread. While we all want to save money on […]

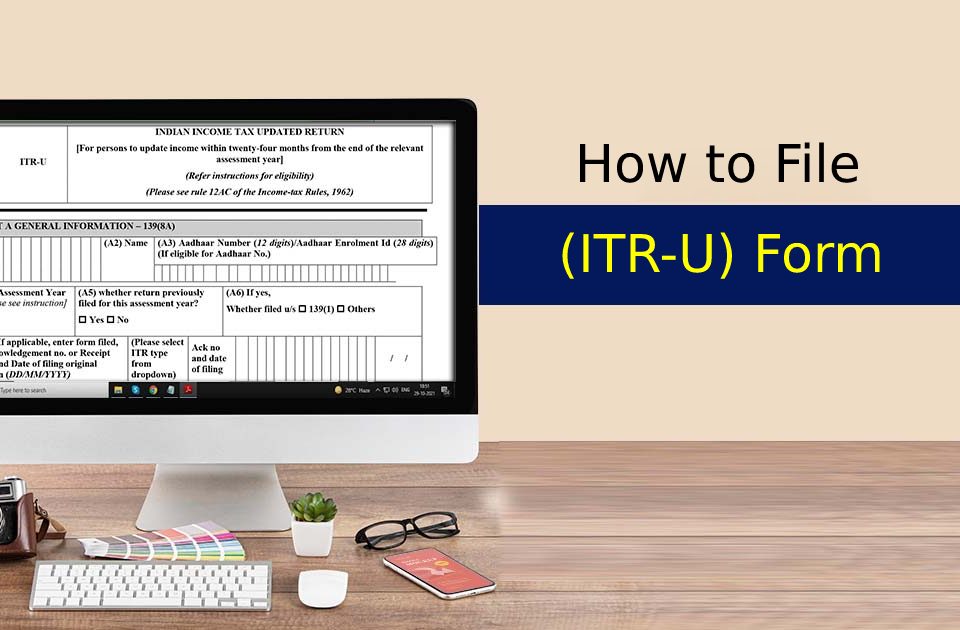

May 10, 2022

Published by Inside Tax at May 10, 2022

Categories

A new form for filing updated IT returns has been announced by the Income Tax Department. In this form, taxpayers should provide the reason for filing […]

May 9, 2022

Published by Inside Tax at May 9, 2022

Categories

As alcohol is always high in demand in a state like Delhi, on the other side it helps in generating a major part of revenue for […]

May 4, 2022

Published by Inside Tax at May 4, 2022

Categories

The GST Council plans to raise the 5 per cent GST slab to either 7 or 8 or 9 per cent. With most states on board […]

April 28, 2022

Published by Inside Tax at April 28, 2022

Categories

The Internal Revenue Service (IRS) has released the earnings tax return (ITR) types for FY 2022-23. The Central Board of Direct Taxes (CBDT) issued a circular […]

March 22, 2022

Published by Inside Tax at March 22, 2022

Categories

Tax is a financial compulsion imposed by the governmental organization to fund various kinds of government expenditures in multiple sectors such as education, public health and […]

February 24, 2022

Published by Inside Tax at February 24, 2022

Categories

Union Budget 2022 has brought multiple changes and modifications in income tax-related services. The recovery from a pandemic, financial challenges and opportunities all combined and bring […]

February 22, 2022

Published by Inside Tax at February 22, 2022

Categories

Section 80G(5) has been amended to provide for electronic filing of Annual Return of donations in Form 10BD received in any financial year beginning from 2021-22. […]

February 9, 2022

Published by Inside Tax at February 9, 2022

Categories

What is TDS? TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as […]

February 1, 2022

Published by Inside Tax at February 1, 2022

Categories

What is TDS? TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as […]

February 1, 2022

Published by Inside Tax at February 1, 2022

Categories

All eyes will be on how the Center balances populist initiatives while treading the tightrope of fiscal consolidation when Union Finance Minister Nirmala Sitharaman presents her […]

January 31, 2022

Published by Inside Tax at January 31, 2022

Categories

January 10, 2022

Published by Inside Tax at January 10, 2022

Categories

Income Tax Return (ITR) is important to file and Income Tax Act, 1961 governs all the policies related to ITR filing. ITR itself is a form […]

December 28, 2021

Published by Inside Tax at December 28, 2021

Categories

We have heard about tax deductions that can be claimed while filing ITR. For example, the premium paid for life insurance can be claimed as deductions […]

December 27, 2021

Published by Inside Tax at December 27, 2021

Categories

Finance act 2021 introduced a new section 194P which offers exemptions to the senior citizen from filing income tax returns. This section came into effect from […]

December 9, 2021

Published by Inside Tax at December 9, 2021

Categories

Earlier, people had two options to define their employment. One was salaried, and the other was self-employed. But now, the third category has evolved, which is […]

December 2, 2021

Published by Inside Tax at December 2, 2021

Categories

Recently government introduced a Composition scheme to simplify GST filing for small taxpayers by reducing formalities. Let’s discuss the same and understand it in a better […]

November 23, 2021

Published by Inside Tax at November 23, 2021

Categories

Income tax is one of the direct taxes that every taxpayer has to pay. But after filing income tax, one needs to file income tax returns […]

November 17, 2021

Published by Inside Tax at November 17, 2021

Categories

The Income Tax Department has announced the roll-out of a new statement namely the Annual Information Statement (AIS) which would provide you with almost all details […]

November 15, 2021

Published by Inside Tax at November 15, 2021

Categories

The full form of MSME is Micro, Small, and Medium Enterprises, and this sector is the backbone of our country’s economy. The MSME industries boost the […]

October 30, 2021

Published by Inside Tax at October 30, 2021

Categories

Goods and Services Tax (GST) was introduced to simplify indirect taxes and unify the Indian market. Apart from this benefit, this tax brought many benefits for […]

October 29, 2021

Published by Inside Tax at October 29, 2021

Categories

Have a great startup idea in mind and want to frame it into a legal business? Then remember that to run any business in India, it […]

October 20, 2021

Published by Inside Tax at October 20, 2021

Categories

According to the latest CBIC notification, a new sub-rule (6) under Rule 59 has been introduced, which can lead to the blocking of GSTR-1 filing. This […]

October 1, 2021

Published by Inside Tax at October 1, 2021

Categories

PAN compulsory on all Sales or Purchase of goods or services above Rs.2 Lakh Ram (Fictional Character): Shyam, PAN is required to be quoted in sale […]

October 1, 2021

Published by Inside Tax at October 1, 2021

Categories

When it comes to legal formalities and approval, the first thing that comes to mind is the signature. Signature is like personally agreeing or witnessing something […]

September 30, 2021

Published by Inside Tax at September 30, 2021

Categories

When starting a business, there are several vulnerabilities attached to the business environment. That is why there are many provisions launched to safeguard businesses from malpractices. […]

September 24, 2021

Published by Inside Tax at September 24, 2021

Categories

Why government extended the dates of ITR filing? Description: Know why the government extended the deadline of ITR filing to 31 December 2021 with reasons. Consult […]

September 10, 2021

Published by Inside Tax at September 10, 2021

Categories

1. ITR filing of deceased person: Documents required, steps to be taken by legal heirs Even after death, a person cannot be absolved of his tax […]

September 9, 2021

Published by Inside Tax at September 9, 2021

Categories

When it comes to business, there are many legal aspects that are framed to provide a safe environment for all operations, and a patent is one […]

September 8, 2021

Published by Inside Tax at September 8, 2021

Categories

As per the GST law, GST is charged on the transaction value of the goods. However, in the case of second-hand goods, a person dealing in […]

August 31, 2021

Published by Inside Tax at August 31, 2021

Categories

No GST on canteen charges recovered from employees In a ruling by the Gujarat bench, the Authority of Advance Rulings (AAR) has held that the canteen […]

August 17, 2021

Published by Inside Tax at August 17, 2021

Categories

Income Tax may sound simple and one may easily define it as a tax imposed on income. Although it is true, there are many regulations involved […]

August 16, 2021

Published by Inside Tax at August 16, 2021

Categories

Goods And Services Tax (GST) was introduced as a replacement for all the indirect taxes that are applied to the supply of goods and services (in […]

August 16, 2021

Published by Inside Tax at August 16, 2021

Categories

Fact and Issue of the case Permission to file Special Leave Petition is granted. This matter has come up before us even earlier. On 28.06.2021, the […]

August 11, 2021

Published by Inside Tax at August 11, 2021

Categories

Usually, we file our income tax for the financial year in March and then file its return for the assessment year in July. The majority of […]

August 10, 2021

Published by Inside Tax at August 10, 2021

Categories

If you are starting your business, the first step is to give a name to your business. According to Companies Act, 213, one can’t register a […]

July 26, 2021

Published by Inside Tax at July 26, 2021

Categories

Every working professional has to pay taxes, and the topmost among the list of taxes is the Income tax. This tax is applicable to everyone who […]

July 12, 2021

Published by Inside Tax at July 12, 2021

Categories

In India over the last few decades, many small/big ventures are emerging tremendously. Along with huge investments, hard work, dedication, and great strategy, one of the […]

June 25, 2021

Published by Inside Tax at June 25, 2021

Categories

How to Find the Best CA Firm in Delhi Hiring the best CA firm is essential for any business. These professionals can help you make […]

June 17, 2021

Published by Inside Tax at June 17, 2021

Categories

An income tax return (ITR) filing is mandatory on individuals earning yearly income excess of the basic exemption limit of Rs 2.5 lakh. Even with no […]

June 15, 2021

Published by Inside Tax at June 15, 2021

Categories

INTRODUCTION In order to penalize those who don’t file income tax returns (ITRs) despite being liable to, the government has proposed new Section 206AB and 206CCA […]

June 10, 2021

Published by Inside Tax at June 10, 2021

Categories

The 43rd GST Council meeting under the Chairmanship of Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman via video conferencing on Friday, 28th day of May, 2021 via […]

June 1, 2021

Published by Inside Tax at June 1, 2021

Categories

Income tax is a critical point. It requires a precise calculation. It is important to realize what percentage of your income is being taxed and how […]

May 25, 2021

Published by Inside Tax at May 25, 2021

Categories

Saving through income tax returns needs a precise strategy. It’s better to get a plan ready for your upcoming financial year to save a good amount […]

May 21, 2021

Published by Inside Tax at May 21, 2021

Categories

The Income Tax Department is going to launch a new E-Filing Portal. In preparation for this launch and migration activities, the existing portal will not be […]

April 14, 2021

Published by Inside Tax at April 14, 2021

Categories

As time has changed, financial literacy among people is increasing and now young learners understand the importance of investment in their life. Once upon a time, […]

April 6, 2021

Published by Inside Tax at April 6, 2021

Categories

Every year, a new budget is introduced to focus on all the economic aspects with a common object to improve the economy of India. Recently our […]