How to File Indian Income Tax Updated Return (ITR-U) Form?

How to apply for a Liquor Shop License in Delhi?

May 9, 2022

Top tax-saving solutions for 2022-23

May 13, 2022A new form for filing updated IT returns has been announced by the Income Tax Department. In this form, taxpayers should provide the reason for filing and the portion of income to be allowed for taxation purposes. ITR-U is the new form and taxpayers can use it to file updated income tax returns for the financial year 2019-20 and 2020-21.

ITR-U form can be filed within two years from the end of the appropriate assessment year. Taxpayers will have to provide proper reasons for revising the income return not already filed or not reporting the income correctly or choosing the wrong heads of income or reducing carried forward loss.

The reasons include shortfall in unabsorbed depreciation or decrease in tax credit under section 115JB/115JC of incorrect rate of tax or other reasons the taxpayer delivered.

Budget 2022-23 has made arrangements so that taxpayers can revise their Income tax return filling within two years, subject to payment of taxes. This move is aimed at helping taxpayers to rectify any discrepancies or omissions. However, there is a limitation as well, a taxpayer can file only one updated return per assessment year.

At present, if the I-T department finds that some income has been omitted by the assessee, it goes through a lengthy process of adjudication, and the new proposal will re-establish trust in the taxpayer.

Earlier Finance Minister Nirmala Sitharaman in her 2022-23 Budget speech said that “To provide an opportunity to rectify such errors, I am proposing a new provision allowing taxpayers to file updated returns on payment of additional tax. This updated return can be filed within two years from the end of the relevant assessment year,”.

An extra 25 per cent will need to be paid on tax and interest due if the updated ITR gets filed within a year (12 months), the rate will reach 50 per cent if the updated ITR gets filed after 12 months but before 24 months from the conclusion of the appropriate assessment year.

However, if a prosecution proceeding has been started by allocating notice concerning a particular Assessment Year, taxpayers will be unable to avail of return benefits of updated ITR in that specific year. Additionally, if the taxpayer furnishes an updated return but payment of the additional taxes has not been made, then the return would be rendered invalid.

Steps to File ITR-U (Income Tax Updated Return) Form

Part A: General Information-139(8A)

- PAN

- Aadhaar Number

- Assessment Year

- Whether return previously filed for this assessment year? (Yes/No)

- If yes, Whether filed u/s o 139(1) o Others

- If applicable, enter form filed, Acknowledgement no. or Receipt No. and Date of filing the original return (DD/MM/YYYY)

- Are you eligible for filing an updated return as per the conditions laid out in the first, second and third provisos to section 139(8A)? (Yes/No)

- Please choose the ITR form for updating your income (ITRs 1-7 to be selected from the drop-down and filled as per the details made available by the e-filing utility – see instruction)

- Are you filing the updated return during the period o up to 12 months from the end of the relevant assessment year o between 12 to 24 months from the end of the relevant assessment year

- (A12) (a) Are you filing the updated return to reduce carried forward loss or unabsorbed depreciation or tax credit? o Yes o No

- (A12) (b) If yes, please specify the assessment years where carried forward loss or unabsorbed depreciation or tax credit is being affected because of this updated return

Part B: ATI Computation Of Total Updated Income And Tax Payable

- 1 (A) Head of income under which additional income is being returned as per Updated Return

- 1 (B) Total income as per last valid return (only in cases where the Income Tax Return has previously been filed)

- Total income as per Part B-TI

- The amount payable, if any (To be taken from the ―Amount payable of Part B-TT of the updated ITR)

- Amount refundable, if any (To be taken from ―Refund‖ of Part B-TTI of the updated ITR

- The amount payable on the basis of last valid return (only in applicable cases)

- 6. (i) Refund claimed as per last valid return if any (Please see instruction)

- 6. (ii) Total Refund issued as per last valid return, if any (including interest u/s 244A received

- Fee for default in furnishing return of income u/s 234F

- Regular Assessment Tax, if any

- Aggregate liability on additional income

- Additional income-tax liability on updated income [25% or 50% of (9-7)]

- Net amount payable (9+10)

- Tax paid u/s 140B

- Tax due (11-12)

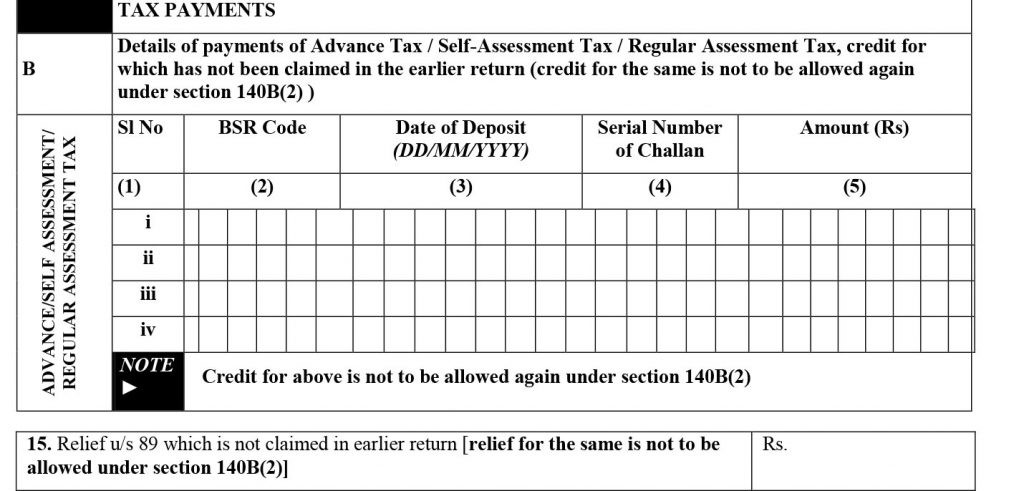

Tax Payments (Only as per Updated Return)

- Details of payments of tax on updated return u/s 140B

- Details of payments of Advance Tax / Self-Assessment Tax / Regular Assessment Tax, credit for which has not been claimed in the earlier return (credit for the same is not to be allowed again under section 140B(2) )

- Note: Credit for the above is not to be allowed again under section 140B(2)

- . Relief u/s 89 which is not claimed in earlier return [relief for the same is not to be allowed under section 140B(2)]

Verification

I, son/ daughter solemnly declare that to the best of my knowledge and

belief, the information is given in the return is correct and complete and is in accordance with the provisions of the income-tax Act, 1961. I further declare that I am making this return in my capacity as _(drop-down tobe provided in e-filing utility) and I am also competent to make this return and verify it. I am holding a permanent account number. (Please see instruction).

Date: Signature: