How to apply for a Liquor Shop License in Delhi?

New Updates In GST Slab 2022

May 4, 2022

How to File Indian Income Tax Updated Return (ITR-U) Form?

May 10, 2022As alcohol is always high in demand in a state like Delhi, on the other side it helps in generating a major part of revenue for the Delhi government. On 29th March 2021, the Delhi cabinet announced a new excise policy for a new Liquor Shop License, intending to change the sale and consumption of liquor. It is intended to revise the minimum age for consumption of liquor by reducing it from 25 years to 21 years.

According to the new excise policy update, the government shows an intention to end the liquor buying experience from Jail by setup up Delhi government-owned liquor shops.

It will result in an upshift towards the privatization of liquor shops in Delhi. Moreover, this article is all about how to set up your liquor shop in Delhi.

Types of Liquor available in the market

There are two types of liquor in the market as follows:-

IMFL – It stands for Indian-made foreign liquor, this type of liquor is strong liquor manufactured within India.

IFL – This liquor is not an Indian origin, it is manufactured outside India and then imported to India, it is usually expensive as compared to IMFL.

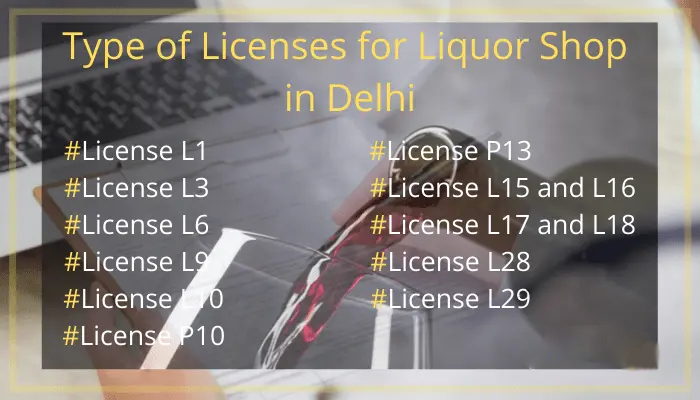

Type of Licenses for Liquor Shop in Delhi

License L1 –

This type of license is required for wholesale vending of liquor to companies, or partnership firms, by an applicant who owns a manufacturing unit.

License L3 –

The role of this license is different from others, the state govt. Grant tender to issue this license. It is granted to working bottling plants, with approval by the central or state government.

License L6 –

This type of license is required for the retail sale of foreign liquor and beers. To issue such type of license an applicant needs to take an undertaking of the government. namely DTTDC, DSIDC, DSCSC, and DCCWS.

License L9 –

This type of license also known as L-52 D is used for the retail sale of foreign liquor to get this license a licensee needs to abide by the terms and conditions given by the state authority.

License L10 –

It is the same as license L9 which grants a user to make a retail sale for both foreign and Indian liquor, but the terms and conditions of L9 do not apply to L10, so a user needs to apply differently for a liquor shop license.

License P10 –

These types of licenses are temporary and grant a licensee to serve liquor at parties, conferences, and functions within a state and not out of the state.

License P13 –

This type of license is required to serve liquor at specific functions organized in hotels whether in or out of state. To get this type of license a licensee needs to abide by the terms and conditions stated by state authority.

License L15 and L16 –

These types of licenses grant licensees to serve liquor in hotels for tourists that are approved by the department of tourism, to get this type of license the hotel management needs to abide by the laws granted by authorities.

License L17 and L18 –

These types of licenses are mostly applied by hotel management staff to serve liquor at hotels, only in commercial areas with appropriate parking facilities such as (offices, and complexes). according to state authority.

License L28 –

Those licensees who owned a club were required to get this license to serve liquor only at clubs. They have to abide by the terms and conditions of the state authority.

License L29 –

This type of license is to serve liquor to the Delhi government. Officials and govt. Servants, the application procedure for L29 is the same as for L28.

The focus is on the L10 license in Delhi

Recently, Delhi Govt. has a central focus on L10 licensee which is for the retail sale of liquor Delhi. For a liquor shop license, an applicant needs to follow the given criteria, and requirements, as well as the attached relevant document needed for completion of formalities. Moreover, you will get to know the license fees that a licensee is subjected to pay for a particular liquor license in Delhi.

Eligibility to apply for Liquor Shop License in Delhi [L-10]

Applicant can be:-

- Companies registered under the company Act, 1956.

- Partnership firm registered under the Partnership Act, 1932.

- Co-operative societies are registered under the relevant co-operative societies Act.

- Sole-proprietorship.

Exception

- Only 1 license shall be granted to a partnership firm, cooperative societies, and companies. Above all, they shall not be eligible to hold more than one license.

- In the case of the sole proprietor, the license shall be granted to the family, and no other family members are allowed to hold any other Liquor Shop license (L10). Moreover, these rules shall not apply to the public sector.

- An L-10 license holder shall not apply for any other wholesale or retail license. Moreover, this condition shall not apply to the public sector.

Documents Required for Delhi liquor shop license

An applicant is required to provide the following given documents :

- A photograph of an applicant.

- Identity proof of the applicant

- Address proof of the applicant

- Shop lawful possession proof such as rent/lease agreement, etc

- Layout plan of the shop

- NOC from the state fire department and municipal corporation.

- An applicant needs to attach an application along with personal and business information.

- The latest copy of the ITR Filing & Income Tax Clearance Certificate.

- An applicant needs to provide an affidavit declaring that there is no criminal record.

- Various affidavits in the name of the applicant.

Procedure for Liquor shop License in Delhi

An applicant is obligated to submit the following documents, along with the following application –

- For a liquor shop License, an applicant needs to provide the relevant document a liquor shop license to the Deputy Commissioner of Excise, Delhi.

- The Proof of lawful possession of the proposed shop is required to provide in the form of an ownership/lease/rental document.

- An applicant needs to provide an affidavit declaring that he is in actual physical possession of the shop for which he has made an application for an L10 license.

- A licensee is subjected to provide a layout plan of his liquor shop, which clearly shows his possession of the shop.

- For a liquor shop license, an applicant needs to provide an income tax clearance certificate, a Domicile certificate that states that a licensee belongs to the state in which he has put an application for a liquor shop license.

- After completing formalities a licensee needs to provide a DD of 8 lakhs in the favor of the deputy commissioner (excise).

- An applicant needs to be assured that nothing is against the application as per the provision of Rule 23, of Delhi excise rules, 2010.

- The liquor shop license shall be granted after completing the formalities from the excise department.

Registration & License required for Liquor Shop License

Trade License

A trade license is a document that allows a business holder to commence a free flow of trade within a particular area on the same side. It is mandatory to get a trade license from local authorities i.e MCD / NDMC.

Trademark Registration

Trademark Registration will provide you with an identity that will benefit you in representing your business and products. It is essential to register your business under Trademark Act, 1999.

NOC is required by Delhi Fire Department

The no-objection certificate (NOC) allows a licensee to open their authorized shop legally with no objection, within a state assigned by local authorities.

VAT Registration

The VAT registration is important for a licensee to pay the liquor shop sales tax for which an applicant needs to the Delhi VAT department and obtain a VAT registration license.

The license fee for Liquor Shop in Delhi

Eligible licensees can apply for an L10 license for their proposed shop. The following fees and security deposit are required to be paid:-

- The annual fee for the L10 license is Rs 8,00,000/- which is to be paid by the licensee in the favour of the Deputy Commissioner.

- The security deposit for L10 is Rs 10,00,000/- which a licensee has to pay in the favour of the deputy commissioner. An amount of the security fee shall be refunded to the license holder on termination of the license within 30 days from the date of termination.

- From the date of granting the license, if an applicant fails to complete the formalities or is not found in their physical possession of the shop. The license fee of Rs 8 lakh shall be fortified.

| The additional license fee for selling Beer

# L12 license entitles a licensee to the retail sale of beer/wine in the departmental store of Delhi. On the other hand, L12F is for the retail sale of foreign beer in the national capital territory of Delhi shall be granted by the Delhi government. # An applicant is subjected to the additional payment of a license fee of Rs 2,00,000/- (Two Lakh Rupees).

|

The additional License fee for Liquor accessories

# If you want to sell liquor accessories on the same premises such as – peg maker, ice-holder, bottle opener. You can apply with the additional license fee payment of Rs.50,000/-. |

Minimum Carpet Area for Liquor Shop in Delhi

Minimum Carpet Area for Liquor Shop in Delhi

The L10 license holder must be in actual physical possession of a shop minimum area of 500 sq. ft. or above carpet area in shopping malls situated at commercial plots (which must be approved by the local authorities e.i MCD/NDMC) or shopping complexes at airports.

The shopping mall must be centralized as air-conditioned, where the number of shops is located or in a set of buildings having interconnected walkways either on the same or different floors with common passage areas. The shopping malls should include a foyer or atrium having a parking facility.

Guidelines for Liquor shop Interior as per Delhi Government Rule

The successful applicant needs to submit the interior plan of their proposed shop enclosing the given following points.

- The shop floor should be designed in a manner to ensure the display of liquor brands with their listed price.

- The interior of the shop should be designed in a manner to ensure proper lighting, flooring, and hygiene.

- A licensee should ensure that the shop should be fully insured against fire and natural hazards. The same shall keep the shop clean and dry with the orders issued by the excise commissioner.

Restricted area to set up a Liquor Shop in Delhi

According to state authorities, there are some sets of rules and regulations for setting up a liquor shop in Delhi. A liquor shop should not be located near any residential area.

It is stated that no liquor shop should be placed within municipal corporations and municipalities within a distance of 50 – 100 meters from any existing place of worship or educational institutions to maintain the decorum of the society.

Rules for Granting liquor shop license by Delhi Government

According to the government of NCT of Delhi, an L10 license shall be granted for the retail trade of both Indian liquor and foreign liquor in Delhi’s shopping malls on a first come first serve basis.

On the scrutiny, if the application is found false or incomplete or violating the terms and conditions. The same shall be rejected and the decision of the commissioner excise will be final.

On the rejection of an application, the earnest amount shall be refunded to the applicant via registered post within 30 days from the date of rejection.

The application is subjected to verification by the competent authority, who may accept or reject the application without specifying any reason. The licensing authority shall not be under any obligations to grant any license for which the application has been made.

Pricing Rules for Retail sale of Liquor in Delhi

The L10 license holder is bound to sell each brand of liquor only at the prescribed price set by an Excise commissioner. Therefore, any overcharging/undercharging of liquor, brands shall be subjected to cancellation of license.

Restriction of Retail Liquor Sale on Dry days

The “Dry-days” are declared by the Delhi government and shall be observed as “dry days”. An owner of an L10 license holder shall not be given any relaxation or any kind of compensation relief in case of increasing the number of dry days during the license period.

You can check the list of dry days from the Government website

Open Hours for retail liquor shop in Delhi

The government of NCT Delhi has approved the policy fixed timing for the retail trade of Liquor in Delhi. The shop is allowed to remain open from 10:00 am – 10:00 pm.

Mandatory Implementation of a Barcode system is mandatory in liquor shops

Every liquor shop in Delhi must do billing through the government ESCIMS barcode system.

For each transaction of the sale of liquor, the L10 licensee must issue the receipt/bill.

The barcode on a particular brand will keep a record of the number/batch no. of liquor brands sold along with their price in a digital format.

The bill/receipt shall include the details of the following points –

- Name of the L10 licensee holder.

- Name and address of the customer.

- Name/quantity/batch no. of a liquor brand.

- Date of sale.

Beneficial to maintain a stock account for the retail sale of liquor in Delhi

- The holder of the L10 licensee shall store such Indian and foreign liquor brands that may be approved by the deputy commissioner.

- The L10 license holder is subjected to maintaining the books of accounts and sales in the prescribed format.

- A licensee shall maintain the day-to-day records in ink format, entering all the figures in international numerals and other particulars in English and Hindi.

Miscellaneous condition of the liquor shop license

- A license holder is required to have a facility of the refrigerator to store and sell 10% of the carpet area of the departmental store. for proper storage of beer and other liquor brands.

- A licensee shall display a board of health advisory in front of the licensed shop. Stating “Drinking is injurious to health”.

- The persons hired by the licensee’s shop all possess an id card under the signature of the authorized signatory. The employees shall be subjected to provide their id cards on demand of the excise officer or sub-inspector.

- The licensee is not subjected to making any kind of advertisement, which is intended to promote the brand or consumption of liquor. Eco-friendly bags can be used or carried to maintain hygiene in liquor shops.

- The licensee shall be bound to furnish any information related to the L10 license truly and faithfully within a reasonable time, as may be prescribed by the Excise Commissioner, excise commissioner, and deputy commissioner.

- Refusal to furnish the information and providing false information shall be regarded as a breach of the terms and conditions of the license. As a result, the licensee has not been subjected to an import/transport permit or maybe cancellation of license.

- The Deputy commissioner reserves the right to cancel or suspend any L10 license. As per the provision of section 17 of the act.

Formalities and Transport permit to L10 holder in Delhi

The L10 license holder shall be bound to procure liquor from wholesalers (L1/1F license holders) at the rates approved by the department.

To procure liquor stock from a wholesaler (L1/L1F license holder), L10 license holders are required to issue Transport permits from the Excise Department. Transport permit is subjected to the advance payment of excise and other levies under the Delhi excise Act, 2009.

Renewal of License fee in Delhi

The Delhi Government has declared that the excise year would be from 1st April – to 31st March. So, the licensee can apply for renewal between the following given dates.

The L10 license can be renewed by the licensing authority, subject to payments and compliance may be prescribed from time to time.

Moreover, if you need any other guidance on applying for a Liquor Shop License, feel free to talk to our business advisors. The professionals of Insidetax are always ready to help you out.

Visit our Website to never miss a fresh update related to your business.