Top 5 reasons why we need digital signature over the traditional one.

October 1, 2021

Your GSTR-1 filing could be blocked from 1st January onwards

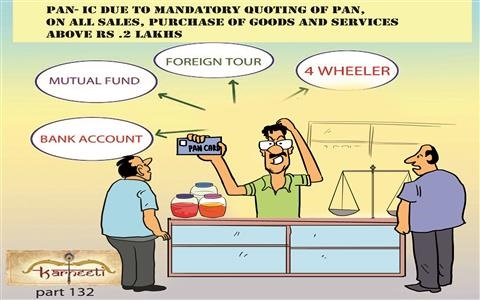

October 20, 2021PAN compulsory on all Sales or Purchase of goods or services above Rs.2 Lakh

Ram (Fictional Character): Shyam, PAN is required to be quoted in sale or purchase transactions exceeding Rs.2 lakh. Which is this hidden income tax provision?

Shyam (Fictional Character): Ram, Income-tax Department has mentioned in rules, when a person is required to obtain PAN compulsorily and where it is required to be quoted or given. Everyone knows that PAN has to be quoted while opening the bank account, affecting transactions of immovable property. But from 1st January 2016 onwards, the law has been changed and now it has been made compulsory to quote PAN where the amount of each purchase or sale of goods or services exceeds Rs.2 Lakh. Many people do not know about this change, so PAN is not quoted in such cases. The responsibility to quote PAN is on both, purchaser and the seller. So each and every trader should understand this provision otherwise he would have to face its consequences.

Ram: Shyam, who is required to compulsorily obtain PAN?

Shyam: Ram, according to section 139A of the Income Tax Act, if a person’s income exceeds the basic exemption limit or his annual turnover exceeds Rs.5 lakh or TDS gets deducted on his income then he would have to compulsorily obtain PAN.

Ram: Shyam, on which transactions quoting of PAN is compulsory?

Shyam: Ram, Section 139A states about quoting of PAN and type and limit of transactions is given in rule 114B,C, and D of Income Tax rules. Out of them, the major transactions and their limits are given below:

- Every person (be it a trader or not) will have to quote PAN in case of all transactions of sale or purchase of any goods or services where the amount exceeds Rs.2 Lakh. For example, if a cloth trader purchases cloth wholesale for Rs.3 Lakh, then he would have to quote his PAN. The buyer will have to give PAN and the seller will have to quote it on all papers like sales bill, etc. after verifying the PAN. The Income Tax Department has given the responsibility of furnishing the PAN and quoting it to the purchaser as well as the seller.

- PAN will have to be quoted while purchasing any motor vehicle except a two-wheeler.

- For opening a bank account or Demat account, PAN will have to be quoted.

- In case the hotel or restaurant bill is paid in cash in excess of Rs.50,000, PAN no. will have to be quoted.

- If the payment for the purpose of a foreign tour or for purchasing foreign currency exceeds Rs.50,000 in cash, PAN will have to be quoted.

- To deposit money in the bank or to buy a mutual fund, PAN will have to be quoted.

- PAN will have to be quoted in case the amount of sale or purchase of immovable property exceeds Rs.10 Lakh.

- PAN will have to be quoted for the transactions on which TDS or TCS have to be deducted.

Many other transactions are there which need to be taken care of.

Ram: Shyam, what should a person do if he doesn’t have PAN and what are the duties of Seller?

Shyam: Ram, if the transaction effected by any person is covered under the aforesaid conditions and if he does not have PAN then he would have to give declaration in Form 60 of Income Tax. If a person earns income from agriculture and if he does not have income from any other source and he filed Form 61, then he will not be required to quote his PAN. Similarly, a nonresident person is not required to quote PAN. Further, the declarations received in Form 60 by the seller from persons who do not have PAN, shall file on line Form 61 as per rule 114D within one month from the end of six months. i.e., for April to Sept, on 31st Oct and From Oct to March, 30th April each year. This rule is also applicable to all Tax Audit Cases. Copy of Form 60 needs to preserve for 6 years by the seller.

Ram: Shyam, what will happen if a taxpayer does not quote his PAN?

Shyam: Ram, if a taxpayer does not quote his PAN for the aforesaid transactions, then Income Tax Officer can impose a penalty of Rs.10, 000 as per Rule 272B.

Ram: Shyam, what the taxpayers should learn from this?

Ram: Shyam, what should a person do if he doesn’t have PAN and what are the duties of Seller?

Shyam: Ram, if the transaction effected by any person is covered under the aforesaid conditions and if he does not have PAN then he would have to give declaration in Form 60 of Income Tax. If a person earns income from agriculture and if he does not have income from any other source and he filed Form 61, then he will not be required to quote his PAN. Similarly, a nonresident person is not required to quote PAN. Further, the declarations received in Form 60 by the seller from persons who do not have PAN, shall file on line Form 61 as per rule 114D within one month from the end of six months. i.e., for April to Sept, on 31st Oct and From Oct to March, 30th April each year. This rule is also applicable to all Tax Audit Cases. Copy of Form 60 needs to preserve for 6 years by the seller.

Ram: Shyam, what will happen if a taxpayer does not quote his PAN?

Shyam: Ram, if a taxpayer does not quote his PAN for the aforesaid transactions, then Income Tax Officer can impose a penalty of Rs.10, 000 as per Rule 272B.

Ram: Shyam, what the taxpayers should learn from this?